Read our In-Depth 2022 eToro Review for eToro Guide.

eToro saw tremendous growth in 2021, adding over 2.5 million new members alone in January and February. Due to its feature-rich trading platform and sizable social trading community of more than 20 million users, eToro has emerged as a global leader in social and copy trading. From desktop and mobile devices, eToro traders actively trade stocks, cryptocurrencies, commodities, forex, CFDs, indices, and ETFs.

With over 20 years of financial experience in stocks, commodities, forex, CFDs, social trading, indices, cryptocurrency, index-based funds, and exchange-traded funds, this eToro review was prepared by professionals in the field (ETF). Only genuine crypto currencies are offered on the eToro platform; eToro USA LLC does not offer CFDs.

The advantages of trading with eToro

78% of retail investor accounts that trade CFDs with this service experience losses. If you can afford to take the significant risk of losing your money, you should.

Describe eToro.

The Assia Brothers, Ronen Assia and Yoni Assia, and David Ring created the eToro worldwide online financial trading platform and multi-asset broker in 2007. The founders of eToro originally called it Retail FX back in 2007.

After more than 15 years, eToro has expanded to offer individual clients trading in stocks, commodities, forex, CFDs, social trading, indices, cryptocurrencies, index-based funds, and exchange-traded funds (ETFs).

A global broker is eToro. There is a headquarters for eToro in Cyprus, UK.

Finding a broker who can suit your demands when trading on the financial markets might take a lot of time.

In-depth analysis of the eToro platform’s performance as a global marketplace for trading numerous financial assets for traders in 2022 will be done in this assessment.

You frequently have to visit and read numerous broker websites, all of which use various linguistic constructions. The language might be highly ambiguous. It can be challenging to select an online broker like eToro. The first few obstacles for a newcomer may be what looks to be a complicated mobile or online trading platform, difficult-to-understand financial jargon, and perplexing cost structures. We outline the benefits and drawbacks in our evaluation of eToro. What eToro can give and in which countries it is accessible. who controls eToro and other information.

Your success in online trading depends on having a trustworthy and competent broker. To prevent losing your cash, be sure your broker is genuine and trustworthy. Check to see whether your needs and your broker’s profile match in order for you to have a successful working relationship.

For this reason, we took the time to examine only the top brokerage firms, their procedures, their fee structure, and all other crucial factors. We urge you to weigh the pros and cons of each broker before entrusting your hard-earned money to them. This eToro review is intended to be informative.

This eToro platform review is pretty thorough. Please take the time to read and thoroughly analyze the entire eToro review if you are considering trading with the platform in any capacity.

In order to give you, the trader, as much information as possible before you begin using the eToro trading tools and depositing and withdrawing money from eToro, we have made an effort to explain the ins and outs of financial trading using the eToro platform as simply as possible.

Online investing carries the same risk as any other offline investment. As with any investment, it’s crucial to understand and thoroughly study the business you’re working with. When trading with eToro, you can trade a variety of financial assets, including stocks, commodities, forex, CFDs, social trading, indices, cryptocurrencies, index-based funds, and exchange-traded funds (ETFs). You should have faith in eToro and be assured that your financial investments on the eToro platform are being managed by professionals.

Learn more about some reputable eToro alternatives at the bottom of this review.

In order to determine whether eToro is a good fit for you, we have provided this eToro review.

The idea that trading online is simple is a prevalent one. Trading online is challenging, and traders need to do their own research and understand exactly what they are doing. You may acquire vital details about eToro in this post that will give you a head start in the world of online trading.

2000+ tradeable assets can be found on the multi-asset platform eToro. Stocks, commodities, forex, CFDs, social trading, indices, cryptocurrencies, index-based funds, and exchange-traded funds are among the assets offered on eToro (ETF).

eToro deals in a variety of financial asset classes. Any security or anything, tangible or intangible, with a monetary value attached is considered a financial asset. As a result, financial assets include stocks, commodities, forex, CFDs, social trading, indices, cryptocurrency, index-based funds, and exchange-traded funds (ETF).

eToro’s features

• Virtual Portfolio, also referred to as a Demo Account.

• Trading API

Social trading is possible.

• Copy Trading is possible.

• StopLoss

• Trajectory Stops

• Orders for TakeProfit

• Offline-Trading

• eToro provides tools for comparing Advanced Financial Charts.

• eToro provides top analysts’ research-backed analysis of the financial markets and investing.

• Users can access the eToro platform online or through a web browser on a variety of platforms, including iOS devices like iPhones and iPads, Android devices, and iOS devices.

• eToro provides a user-friendly trading platform with tools for both novice and seasoned traders.

Why Using the eToro platform in more than 5 different languages is advantageous for users.

What you must understand

Nine trading options are available on eToro: stocks, commodities, forex, contracts for difference (CFDs), social trading, indices, cryptocurrency, index-based funds, and exchange-traded funds (ETF). The goods and assets you can access on the eToro trading platform vary depending on where in the world you are and with whom you have an account.

You must make a $50 minimum deposit to use eToro. To familiarize yourself with the eToro platform, you can register for a demo account.

Whether you are a novice or an experienced trader, eToro can accommodate all levels of traders.

Is eToro secure?

The administrative structure and regulatory standing of the broker are crucial factors to consider when selecting a broker like eToro. Brokers that work independently from a regulating body do so at their own discretion. Your investment capital is at danger.

eToro was founded in 2007 and has been in business for 15 years. Its headquarters are in Cyprus, UK.

eToro is governed. This indicates that the Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), Markets in Financial Instruments Directive (MiFID), and Australian Securities and Investments Commission (ASIC) regulatory authorities control and monitor eToro’s behavior, respectively.

Due to the regulations put in place, regulated brokers are very unlikely to manipulate market pricing. Your withdrawal request will be honored once you submit it to eToro. If eToro break any regulations, they risk losing its regulated status.

78% of retail investor accounts that trade CFDs with this service experience losses.

With eToro, is my money secure?

Any funds added by traders to their eToro accounts are kept in a separate bank account.

Tier-1 banks are used for this by eToro for added security. The standard metric for assessing a bank’s financial health and soundness is Tier 1.

Why should eToro utilize Tier 1 banks? What are they?

Regarding customer capital, a Tier 1 bank is regarded as the safest and most secure. The phrase “tier 1” actually refers to a bank’s financial stability. A Tier 1 bank often has substantial core capital reserves and is able to sustain unforeseen losses.

What does it indicate if you have money placed in a Tier 1 bank from eToro?

Any funds you deposit with eToro are stored in a bank with sufficient capital to handle your withdrawal requests even in the event that eToro goes out of business.

We can therefore say with confidence that eToro is relatively secure and secure.

Please keep in mind, though, that trading in financial assets carries some risk. Accounts may face losses as a result of insufficient market research, a lack of competence, or a failure to utilize the brokerage platform’s resources.

Trading stocks, commodities, forex, CFDs, social trading, indices, cryptocurrencies, index-based funds, and exchange-traded funds (ETF) can result in a quick loss of money. Only engage in trading when you are aware that there is always a chance that your invested money could be lost due to market volatility. Additionally, eToro makes it quite apparent on its platform that 78% of accounts held by regular investors lose money while trading CFDs with this supplier.

Now that we’ve addressed some crucial eToro-related queries. Let’s take a closer look at the eToro features.

When using eToro, consider opening two accounts. The first is your genuine account with real money, and the second is your practice account. Your test account is the demo account.

78% of retail investor accounts that trade CFDs with this service experience losses.

Full disclosure: If you join a broker via one of our links, we might get paid.

Pros and Cons of eToro

Why we enjoy using eToro

• Applied by more than 27,000,000 traders and eToro users.

• Founded in 2007

• Controlled by the Australian Securities and Investments Commission, Cyprus Securities and Exchange Commission, Financial Conduct Authority (FCA), and Markets in Financial Instruments Directive (MiFID) (ASIC)

• Minimum deposit is $50

What eToro has that we don’t like

• Prohibits scalping

More information on eToro Regulation and Licensing

According to our research, eToro is overseen and regulated by credible organizations. You may look up each regulatory and oversight authority for eToro listed below. Regulation gives you some options if you’re having problems with eToro. Regulating bodies safeguard investors with programs like reimbursement plans that allow clients to get their money back in the event that a broker goes bankrupt.

In order to maintain their licenses and carry on business in such jurisdictions, brokerage firms must adhere to a variety of regulations and standards set by those regulatory bodies. The goal of regulation is to safeguard eToro traders and create a more secure trading environment.

European eToro users

The European Union’s European Economic Area and members outside of the European Economic Area are served by eToro (Europe) Ltd, which is governed by the Cyprus Securities and Exchange Commission (CySEC). Investor protection starting at 20,000 EUR is available to clients utilizing eToro Europe Ltd to trade in other European nations.

Clients of eToro UK

The FCA is in charge of eToro (UK) Ltd., and it holds an FCA license to provide eToro services within the EU. Investor protection for clients in the UK starts at £85,000.

Customers of eToro in Australia

The Australian Securities and Investments Commission regulates eToro Australia Pty Ltd. For clients in Australia, Gleneagle Asset Management Limited, which is an authorized corporate agent of eToro Australia Pty Ltd., holds an Australian Financial Services Licence.

Users of eToro in the United States of America

The company that runs eToro USA is eToro USA LLC. eToro USA LLC is listed with FinCEN as a money services business.

Reputable financial regulatory organizations oversee, control, and regulate eToro. Regulatory organizations keep an eye on the brokers’ actions, and if something goes wrong, they will take the appropriate action. Make sure an online broker is a legitimate internet agency before dealing with them, such as eToro.

eToro: Is it Global?

Since eToro is accessible in over 140 countries, the answer is undoubtedly yes.

Insofar as it operates in 140 nations, including those in Oceania and Europe, eToro is a truly worldwide trading platform. The UK, Germany, Australia, Thailand, and the United States are among the major nations that eToro serves. According to its Wikipedia website, eToro has more than 27,000,000 users in total. Excellent numbers from eToro. There have been rumors that eToro would start operating worldwide as of 2021. Depending on the state you reside in if you are a resident of the United States, only specific trading capabilities and financial markets are accessible on the eToro platform. The regulatory limitations in the US are to blame for this. Additionally, eToro is unable to grant US citizens who reside abroad access to its site.

Awarded by eToro

Over the 15 years that eToro has been a financial broker, they have garnered numerous industry accolades. The most noteworthy eToro accolades and mentions are mentioned below.

• Best Social Trading Platform 2019 Award Recipient at ADVFN International Financial Awards

Winner of the Best Platform for Trading Cryptocurrencies category at the 2019 ADVFN International Financial Awards

Winner of the 2010 Money AM Online Finance Awards for Best Active Trading Platform

• 2011 Winner of the World Finance Foreign Exchange Award for Best Software Provider and Best Mobile Trading Platform

• 2012 Best Use of Social Media Winner at The Share Awards

• Best Trading Platform 2013 Star Awards

How eToro Fees Work

• There is a $5 charge associated with eToro withdrawal requests. Additionally, conversion costs apply to withdrawals received in currencies other than US dollars.

A fee is levied by eToro for inactive accounts.

• There are no deposit fees at eToro.

Modern internet trading platforms, mobile trading applications, financial research tools, and instructional resources are all provided by brokers. For a brokerage to continue offering these services and generate income as a business. You should be informed of the numerous trading fees that brokers may charge their consumers because they could have an impact on your bottom line.

The cost of trading on eToro is determined by the financial item being traded. When trading stocks and ETFs, there are no trading costs. However, there are associated trading costs (which are the market average for particular financial instruments) when trading Forex or CFD trades on the eToro platform. Unlike some trading systems, there is no management cost for holding an eToro account. Some costs, such as the $5 withdrawal fee, are not related to trading.

Minimum Deposit for eToro

When opening an eToro trading account, a minimum investment of 50 GBP/USD/EUR is required.

The smallest sum of money needed by eToro to start a new online brokerage account is known as a minimum deposit.

Don’t let brokers like eToro frighten you away by requiring a minimum deposit to start a trading account. Higher minimum deposit brokers frequently provide extra premium features on their platforms that are not offered for free on other platforms.

Brokers with smaller minimum deposits typically target a more general market that doesn’t need some of the more sophisticated features and research tools.

Brokers that don’t require minimum deposits typically do so to draw in new clients. Transaction commissions and other trading fees could be greater with a low minimum deposit account since they need to generate returns in some other way.

Brokers with higher minimum deposit requirements typically have a wider selection of trading features available on their platforms. These brokers frequently have superior risk management features and more thorough technical analysis and research capabilities.

The minimum amount needed to start a live trading account has decreased as more online trading platforms have joined the market and as more brokers compete for new customers.

Some brokers demand a minimum deposit as high as 6500 GBP/USD depending on the type of trading account you choose. Some brokers provide exchange rates up to 10,000 GBP/USD.

Past performance is not an indication of future results.Withdrawal fees for eToro

Requests for withdrawals from eToro are subject to a $5 withdrawal fee, or 3.66 GBP. Additionally, since the USD is eToros’ base currency, withdrawals submitted in currencies other than USD will also incur conversion costs.

For Platinum or Diamond eToro Club members, there is no withdrawal cost and the eToro withdrawal fee is waived. You must have at least $25,000 in eToro equity to join the club as a Platinum member. There are numerous extra advantages to becoming an eToro Club member.

The minimum withdrawal amount on eToro is $30, and you can only withdraw money that is in your available eToro balance. You’ll receive a message from eToro once your withdrawal is finished.

Each broker has its own unique withdrawal policies that govern how money can be taken out of trading accounts.

This is due to the fact that every brokerage house will have a distinct withdrawal process, and every payment provider may have various transfer processing costs, processing delays, and potential currency conversion fees. Your base currency, your receiving currency, and your payment provider all affect the conversion fee.

Withdrawal options on eToro

The same payment method used to fill your account is typically utilized to withdraw eToro funds. Credit card, PayPal, and bank transfer withdrawals are given priority by eToro by default. However, eToro is able to support a variety of payment methods, and you can withdraw your money using credit cards, debit cards, bank transfers, PayPal, Neteller, Skrill, WebMoney, China UnionPay, Giropay, electronic wallets (eWallets), Ethereum, bitcoin, bitcoin cash, dash, EOS, ripple xrp, litecoin, zcash, and payoneer, among others. Conversion fees may vary depending on the type of payment used.

For instance, eToro permits withdrawals to credit cards, debit cards, bank transfers, VISA, MasterCard, Maestro, Neteller, Skrill, WebMoney, Giropay, and electronic wallets (eWallets).

Inactivity Fees on eToro

For accounts that are inactive, eToro does levy a fee.

A fee is assessed to the registered brokerage client known as an account inactivity fee.

According to the terms and conditions of the accounts, clients may be required to comply with certain trading activity requirements set forth by brokers.

An inactivity fee could be owed if a client’s trading account doesn’t engage in any buying and selling for the predetermined amount of time set by the broker.

Online trading accounts are not the only ones that incur inactivity penalties. There may be inactivity fees levied by several financial service providers. Make sure you are informed of and satisfied with all the services and costs you can be charged by visiting the broker’s website.

Close your trading account if you are no longer using it by contacting the broker’s customer service. A certification that any outstanding fees are not owed should also be obtained.

You may only be assessed an inactivity fee under specific conditions, depending on the type of account you have opened. A broker is required by regulation to disclose any inactivity costs in full.

To make up for the lack of commission fees from your trading, certain brokerage firms may levy inactivity fees in exchange for keeping your account active on their pricey trading platforms.

Deposit fees for eToro

There are no deposit fees at eToro. Despite the possibility of bank or third-party merchant fees.

As some brokers may charge a fee when you deposit money from your payment method to your trading account, you should constantly verify the deposit fees. This is due to the possibility of fees associated with the payment method you use to fill your account.

When you add a certain type of fiat currency to your account, a fixed fee can apply. For instance, it is well knowledge that costs are high when making a credit card deposit. If your broker permits credit card funding of your account, then this will apply.

Commission Fees on eToro

On investing in genuine stocks and ETFs, eToro charges no commission.

In exchange for enabling the purchase and sale of financial assets through your trading account, a broker may charge a commission fee.

The majority of a brokerage’s income can come from commission fees levied on customer transactions to registered traders.

Depending on the type of trading you do, the type of financial asset you are using, and the size of your trading account, commission costs can vary.

If the brokerage completes, cancels, or alters an order on your behalf, broker commissions will be assessed.

Typically, no commission is assessed if your brokerage does not fulfill a market order.

Be advised that your brokerage may impose a commission fee if your order is changed or canceled.

Review of eToro

What products can you trade on eToro?

Due to regulatory limitations, different firms operating under the eToro Brand may provide various trading instruments. Depending on the entity holding the customer account and the client’s country of residence, several trading instruments may be available. Additionally, the eToro trading platforms that you choose to use may change the trading instruments that are available to you.

With eToro, you may trade a huge selection of instruments—more than 2000 instruments in total.

EToro offers more than 50 currency pairs if you’re seeking for Forex brokers to trade currency pairs on international Forex marketplaces.

The table below compares eToro to IC Markets and Roboforex.

78% of retail investor accounts that trade CFDs with this service experience losses.

eToro stock purchases

As a multi-asset platform, eToro is able to provide investors with zero commission stock trading on more than 2000 stocks and shares from 17 international financial exchanges.

Stocks with no commission on eToro

When you purchase and sell stocks using the eToro web platform or mobile app, no additional costs are assessed on the buy or sell orders. This is known as the “Zero Commission on Stocks” service. This is a significant advantage of purchasing shares with eToro as most other brokers impose a transaction fee for carrying out a purchase. On the eToro platform, there is no limitation or limit on the number of shares you can buy with no commission.

It’s important to keep in mind that the eToro $0 commission charge offer only applies to trading in equities without leverage. Therefore, stock CFD trades are not eligible for this zero commission offer.

Depending on the regulatory body you fall under, the zero commission offering varies a little bit as well. Customers in the United Kingdom who are subject to the Financial Conduct Authority’s jurisdiction and customers in Cyprus who are subject to the Securities Exchange Commission’s jurisdiction, for instance, will have zero commission applied to the majority of available eToro stocks and shares.

The 0% commission offered by eToro only applies to all accessible US equities and shares for Australian residents who use the platform and are subject to the supervision of the Australian Securities and Investments Commission. Users in the US are not allowed to purchase Zero Commission stocks.

The low minimum trading amount on eToro is $10 USD, which, depending on the exchange rate, equates to approximately £8.5 GBP. On non-leveraged equities, eToro does not charge any overnight fees.

In contrast to certain brokers, eToro does not charge its customers any management, ticketing, or admin fees. Regrettably, some eToro rivals could impose a quarterly administration fee.

Because of the scale of their customer base, eToro is able to provide extremely attractive incentives like 0% commissions. With more than 20 million users globally, eToro is able to pass savings on to their users and maintain a very low price when compared to other brokers thanks to the volume of transactions it processes.

Trading with eToro: Stamp Duty and Financial Transaction Tax

You must make sure you are in compliance with local tax authorities when trading. For eligible registered clients, eToro covers the cost of stamp duty and financial transaction tax. For customers of eToro in the UK, this might result in a 0.5% savings. Irish citizens can save up to 1%, French consumers can save 0.3%, and Italian customers can save 0.1%. Visit the eToro website to learn more. Depending on where you live, taxes may be due on all forms of financial assets, including stocks, money, and cryptoassets.

On eToro, own the underlying stock.

You can trade equities on eToro if you genuinely possess the underlying asset. This is crucial since certain brokers can only provide CFD trading on stocks and shares.

A non-leveraged stock is registered on the eToro platform when you purchase it. You won’t receive a stock certificate or voting rights, but if the stock issues dividends and you meet the requirements, the dividend amount will be added to your eToro balance.

If you meet the requirements for that financial asset, you are eligible to receive dividend payments because you can possess the underlying asset on a stock trade.

However, if you prefer to trade conventional stocks and shares, eToro also allows registered users to trade leveraged CFD stocks. From the eToro web trading platform or the custom eToro mobile app, which is available for Apple and Android smartphones, stocks and shares can be bought and sold.

Stock trading and copy trading on eToro

You can use eToro’s well-known social trading and copy trading features when you open an account with them to trade in company stocks and shares. By using eToro’s exclusive CopyTrader and CopyPortfolio copy trading platform capabilities, you can follow other traders and investors on the eToro platform. A type of social trading is copy trading. Users can view the stock trading performance of top performers on the eToro site and copy their trades by using these eToro copy techniques. Users can search through thousands of financial instruments to discover a well-known investor who fits their needs and trading approach. Alternatives to automated robo advisers, such as copy trading platforms like eToro, have gained popularity.

CopyTrade and CopyPortfolio on the eToro investment platform also provide social trading users access to numerous asset classes like cryptoassets, commodities, currencies, ETFs, Indices, and equities trading. You are not simply confined to stocks. There are several trading ideas on eToro.

On eToro, copy trading allows users access to the trades of more than 20 million users from over 100 nations, including the UK. Making trading judgments is aided by copy trading and social trading. This offers up new possible investment methods and revenue streams via copy trading eToro because no other trading platform, including alternatives to eToro, is currently able to provide its customers with this.

Your copy trading eToro portfolio can be linked with the portfolios of other eToro traders once you have established your investment and trade limitations. All of the deals made by the trader you have copied on eToro are replicated to your account. Your eToro account receives an automatic copy of any upcoming purchase or sell orders.

To help limit risk and minimize loss, eToro has safety precautions in place. For instance, the maximum number of traders a user can replicate is 100. A minimum of $200 is needed to copy another trader, and a minimum of $1 is needed for each position that is duplicated. Any duplicated transactions that are manually closed will be credited to your eToro account copy balance. The default stop loss with eToro CopyPortfolios is 10%.

On the eToro social trading website, you can mimic the trades of individuals who have a track record of success.

Keep in mind that, especially with copy trading, whatever you read or data you are given should be treated with a grain of salt. Any information or study that is given to you, including investing advice from people you do not know or other investors, requires that you conduct your own investigation, due diligence, and analysis. Using a copy trading platform does not guarantee success in the future.

Trading Cryptocurrencies on eToro

All of the major cryptocurrencies, including Bitcoin (BTC), Ripple (XRP), Ethereum (ETH), Ethereum Classic, Bitcoin Cash (BCH), Dash, Stellar Lumins (XLM), Neo, EOS, Cardano (ADA), IOTA, TRON, ZCash, Tezos, and Litecoin, are available for trading on eToro (LTC). Either you are an experienced cryptocurrency trader or you are interested in learning more about trading cryptocurrency, eToro’s crypto services will be beneficial to you.

crypto wallet eToros

The eToro cryptocurrency wallet software allows you to store your crypto holdings. With military-grade encryption, the eToro crypto wallet is a safe online crypto wallet. Over 120 cryptocurrencies can be stored, purchased, sold, sent, and received using the eToro wallet, which also functions as a cryptocurrency exchange. Active cryptocurrency traders can handle a variety of cryptocurrencies at once with the help of the eToro wallet.

In recent years, the popularity of cryptocurrency trading and the desire of traders to move funds in the form of cryptoassets has grown exponentially. To meet the demands of nearly 20 million consumers, eToro is improving its cryptocurrency products. eToro offers Crypto CopyPortfolios as a result. Users of eToro can benefit from copy trading with cryptocurrency through crypto copy portfolios.

Managed Cryptoasset Trading with eToro Crypto CopyPortfolio

Users of eToro have access to CopyPortfolios, a managed cryptocurrency portfolio product, in addition to trading conventional financial items related to cryptocurrencies.

By making an investment in CopyPortfolios, traders and various markets will be automatically copied based on a defined investing plan. Recognize that eToro CopyPortfolios are not exchange traded funds or hedge funds.

CopyPortfolios give traders a diversified exposure to the markets for crypto currencies. The CopyPortfolio cryptocurrency assets are divided by their market capitalization starting at 5%. For eToro CopyPortfolios, the minimum investment is $500 USD. Recognize the difference between trading in individual crypto assets and copying the trades of eToro users who trade in crypto assets. The managed service Crypto CopyPortfolio is a different one.

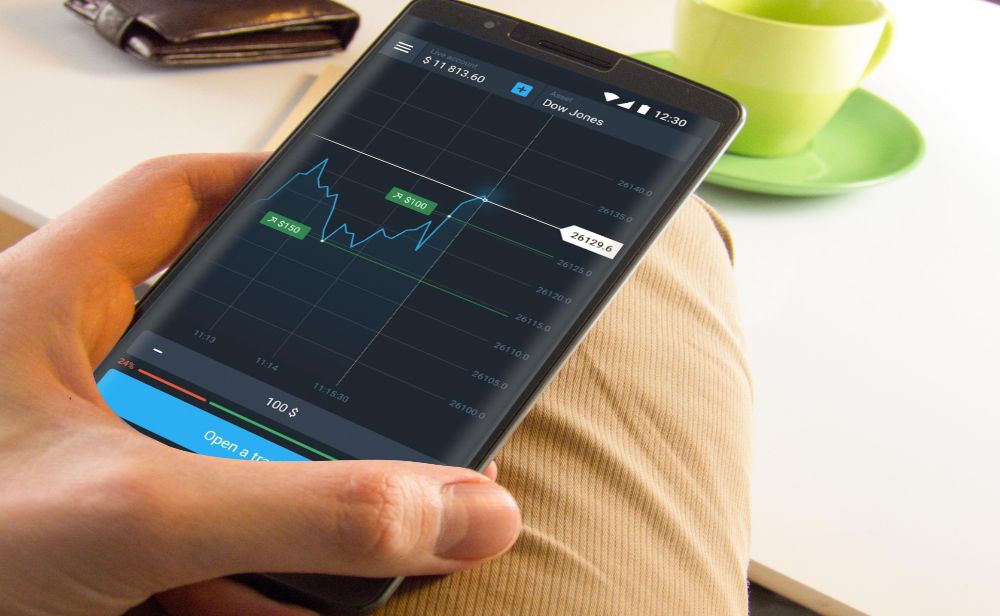

eToro web platforms and other applications trading

A user-friendly custom trading platform is offered by eToro and is accessible through a web browser. You can click here to view a comparison of MT4 brokers if you like.

In order to make it simpler for you to monitor and complete your trades while you’re on the go, eToro also provides mobile apps for Android and iOS.

Future outcomes cannot be predicted by past performance.

The links below will let you download the apps for iOS and Android. Users of the eToro apps for iOS and Android say they are simple to use.

How secure is the eToro Trading Platform?

Through SSL encryption on both PC and mobile platforms, eToro protects its customers’ private information. Through its web platform, eToro also exhorts users to always check for the SSL security indicator (a lock sign) while using the site.

Options on the eToro Trading Platform

The MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader trading platforms are not available on eToro.

eToro provides a proprietary trading platform that was created and tested internally. Traders may maintain their portfolios, keep tabs on the markets, find trade ideas, and execute trades using the eToro trading platform.

Traders can search the financial market for trading opportunities that meet a set of criteria using the eToro platform.

With the help of actionable research and stock evaluations, you may search for and assess opportunities with eToro. Access news and quotes in real-time streaming on the eToro platform. Utilize eToro’s robust charting tools to find potential trades. eToro is accessible online via the cloud or as downloadable programs. With eToro, you can keep an eye on your orders and get the latest market information.

Trading Dashboard for eToro

Future outcomes cannot be predicted by past performance.

Main Dashboard Screen for eToro

After entering your safe eToro trading account, the first thing you will see is the trading dashboard. To gain a rapid snapshot of the state of the financial markets, use the eToro dashboard.

A live price summary of securities and other financial assets is shown on the main screen. These are actual market prices that are being updated in real time all the time.

You can check out how the most well-liked stocks, commodities, indices, currencies in the foreign exchange market, digital currencies, and other financial assets are doing on the active markets.

The user interface is uncluttered and has a straightforward left navigation panel.

Dashboard navigation on eToro

The eToro trading platform’s main navigation is constantly accessible. Whatever you need will always be just a couple of clicks away, whether you are browsing on a desktop computer or mobile device.

Active traders need a trading platform that reacts swiftly to their activities and has a decent, simple user interface (UI) design. The financial markets may be incredibly unpredictable, and how a trader reacts to news and movements in the market can make or break a trade.

The eToro platform feels really robust, and the navigation is beautifully designed and responsive.

You may rapidly review markets and find what you need by using the navigation options on the left panel of the eToro trading platform.

• Watchlist on eToro

• Portfolio tracker on eToro

• Market News Streams

• eToro’s Market Trading

• Trade like other traders on eToro by copying them.

• Use eToro to invest in CopyPortfolios.

• Dashboard for eToro Club

• Tell your friends about eToro

• eToro’s Help Center

• The eToro Guides

• Take money out of eToro

• Toggle between eToro Demo and eToro Live markets

• Use eToro to look up markets and personalities.

Charting on eToro

Future outcomes cannot be predicted by past performance.

ProCharts on eToro

A couple really decent charting solutions are available on eToro. You can see an eToro ProCharts candle chart for Apple Computer Inc. in the image above.

You may customize these charts on eToro to alter how they are shown. The chart data feed period can be changed from one minute to one week. The graph instantly updates. If you plan to actively trade on live financial markets, it’s crucial that you completely comprehend the variety of charts and tools available on the Etoro platform. Despite being challenging at first, practice and spending the time to grasp these tools will eventually make them simple to use and increase your chances of trading success.

Types of eToro Charting

The following chart formats are available on eToro:

• Candle

• Candle with a Hole

• Bar

• Line

• Mountain

Tools for eToro Charting

The following charting tool choices are available on eToro:

• Measure

• Channel

• Annotation

• Fibonacci

• Horizontal

• Vertical

• Line

• Ray

• Segment

• Rectangle

• Eclipse

• Doodle

• Pitchfork

Studies on available eToro charts

The following charting tool studies are available on eToro:

• Distribution and Accumulation

Index Accumulative Swing

• DMS / ADX

• Alligator

• Aroon

• The Arron Oscillator.

• True Average Range

• Fantastic Oscillator

The Bollinger Bands

• Gravity Center

• The Chaikin Volatility

Oscillator Chande Forecast

Momentum oscillator by Chande

Index Commodity Channel

Coppock’s Curve

• Detrended Price Indicator

Channel Donchian

the Ehler Fisher

Index for Elder Ray

• Fractured Choas Bands

• The Fractal Choas Oscillator

• Low-High Bands

• Low Minus High

Maximum High Value

• Previous Volatility

• Clouds Ichimoku

Index of Intraday Momentum

Kelly Channel

Linear Regulated Forecast

Intercept linear regulation

R2 Linear Reg.

• Regular Linear Slope

• Minimum Low Value

• MACD

• Mass Count

• Median Cost

Indicator of momentum

Cash Flow Index

Movable Average

• Mean Absolute Deviation

Using the Moving Average Envelope

SAR using a parabola

• Turning Points

• Fairly Effective Oscillator

Pricing oscillator

• Price Change Rate

Bands of prime numbers

Oscillator for prime numbers

• QStick

Index for Random Walks

• Ravi

• RSI

Shaffer Trend Cycle

Regular Deviation

Indicator of Stochastic Momentum

• Stochastics

Index Swing

• Time Series Prediction

• TRIX

Real Range

• Average Price

• The Supreme Oscillator

• Horizontal Vertical Filter

Weighted Closing

Williams, R.

eToro Chart Stats and Indepth Details

Future outcomes cannot be predicted by past performance.

eToro allows you to examine easy to use extensive statistics on financial securities and other assets.

In the image above you will see that you can alter the date range of the AAPL chart, view the previous close, days range, 52 week range, average volume, 1 year return, market cap, profit / earnings ratio, revenue, EPS and dividend yield. All conveniently available within the eToro platform. Charting tools are highly useful when trying to examine market circumstances trying to monitor and discover patterns that may benefit your investment strategy.

eToro Financial Summary

As you scroll down the eToro statistics page you can view a financial summary of your selected security.

This includes some extremely helpful information including income statements, balance sheets and cash flow statements.

eToro News Feeds

Future outcomes cannot be predicted by past performance.

eToro have a news feed built into the platform where you can read the market news from other traders on the eToro platform.

These news feeds are quite active allowing you review market occurrences and gain a feel of market trends and mood. Although some of this material may be valuable you should perform your own independent investigation and verify any piece of information you act on.

eToro CopyTrader

Future outcomes cannot be predicted by past performance.

eToro have an interesting product called eToro CopyTrader.

eToros CopyTrader allows registered users to mimic trades of other succesful traders on the eToro site.

For simplicity and ease of use, eToro designed the Copytrader page by Editors pick, Most Copied, Trending, Top Investors, Lower Risk Score, Medium Risk Score.

You may also search the eToro platform for specific successful traders in the niche that you are looking to trade in and view their news feed, examine their trading statistics and performance.

eToro Copy People Search Filters

You can narrow your search for traders to copy by certain country.

You can filter the sort of market you want your traders to trade in for example: Forex brokers dealing currencies, Crypto, Commodities, Indices, Stocks and ETFs.

Another wonderful feature is that you can filter traders to replicate by the average percentage their trading is gained. You can write in a number for example show just traders who have gained 10% over the last 12 months. You have a length filter that accompanies the percentage gain filter, this means you might return traders that have gained 10% over the last 1 month to 2 years.

A very fascinating feature. But of course you have to take these tools with a pinch of salt. Do your own research before committing to any trading activity.

eToro Copy People Trader Statistics in Detail

As you can see from the screen grab above you can see a specific traders trading performance historically by month and year. Understand that when you view any of these numbers, although easy to use past trading performance is not an indicator or guarantee of future trading performance. eToro refreshes these statistics data every day.

eToro Trader Risk Score

eToro display a risk score for each trader. This trader risk score is an average generated using eToros custom risk score algorithm utilizing data from that user over the last 7 days. You can observe how a traders risk score has changed over prior months and years. You have an average percentage of that traders max drawdown over the last day, week and year. The eToro risk score is a rating from 1 to 10. A risk score of 10 indicates a high-risk trader on eToro, while a risk score of 1 indicates a low-risk trader.

How many other registered eToro users are imitating this trader can be seen on the trader statistics detail page. 19,892 traders are copying the trader in the screenshot, as you can see.

Breakdown of eToro Trader Trading Types

A breakdown of the different financial assets and securities they are trading may be seen as you scroll down the trader statistics page.

The total number of trades finished throughout the previous year is visible. The trade data is presented as a percentage, broken down into how much of these trades were in equities, indexes, cryptocurrencies, exchange-traded funds (ETFs), commodities, and currencies.

Average Trading Stats for eToro Trader

The average percentage of profitable transactions and the average number of traders who lost money are two of the most crucial variables in this table. A proportion of profitable deals is shown in the top right corner.

You will be able to examine which securities your chosen trader trades the most frequently and how lucrative their trades of those financial assets were.

On the eToro platform, you may view information about a trader’s average weekly trade volume, average holding period, average number of profitable trading weeks, and date of first trade completion.

Purchasing a copy portfolio

Future outcomes cannot be predicted by past performance.

The eToro CopyPortfolios offering is a portfolio management tool. Clients of eToro are able to mimic markets and traders based on a pre-established trading strategy thanks to CopyPortfolios.

Exchange traded funds or hedge funds are not appropriate terms to use when describing eToro CopyPortfolios.

Top trader portfolios, market portfolios, and partner portfolios are the three areas that make up the eToro CopyPortfolio website.

Benefits of eToro Trading

• Provides STP

• Minimal deposit

• Provides Negative Balance Defense

• One of the least expensive venues to purchase stocks is eToro. Customers buying stocks with a 1x leverage are actually purchasing the underlying stock. With certain brokers, this is not necessarily the reason.

Offering eToro Trading Accounts

The several account kinds that eToro offers are summarized here. The many eToro account kinds can give you everything you need, no matter what kind of trading you want to do.

• Trial account

• Regular account

• Account STP

• A Muslim account

Can I test out eToro?

Before making any financial contributions, you may test out eToro’s demo account. Open a demo account to practice trading.

78% of retail investor accounts that trade CFDs with this service experience losses. If you can afford to take the significant risk of losing your money, you should.

eToro funding and withdrawal procedures

Please be aware that the eToro Entity and the Client’s Country of Residence may affect the selection of eToro payment options below.

You can check your eToro members area on the eToro website to see all the available eToro payment options.

eToro accepts the following payment types for funding. If they are accessible in your area, you can utilize any of the deposit options listed below. find out more about eToro

Payment Methods for eToro

• Credit cards are accepted on eToro.

• eToro takes VISA.

MasterCard is accepted on eToro.

• Maestro is accepted by eToro.

• Debit cards are accepted on eToro.

• Bank transfers are accepted on eToro.

• PayPal is accepted on eToro

• Neteller is accepted by eToro.

• Skrill is accepted by eToro

• WebMoney is accepted by eToro.

• eToro recognizes Giropay.

• eToro is compatible with digital wallets (eWallets)

How can I begin using eToro for trading?

You must register here in order to start a trading account with eToro. The next step is to download the trading platform of your choosing after you have submitted your identification documents for account validation, received your login information through email, and made a deposit. Here, you may discover comprehensive instructions about eToro trading platforms. As part of the eToro onboarding process and routine KYC identification checks, you will be required to present some basic evidence to support your identity. These checks are common practice and assist eToro in giving their 27,000,000 members a secure financial setting.

78% of retail investor accounts that trade CFDs with this service experience losses.

Executing deals using eToro

You can perform trades with eToro for as little as $25. Depending on the account you open, this can change. You can trade a maximum of 20% of equity on eToro. Since eToro offers STP execution, you may anticipate tighter spreads and increased transparency on the cost of executing your trades.

The amount of margin needed varies based on the instruments, as with most brokers.

Additionally, eToro provides a variety of helpful risk management tools, including limit orders, stop losses (including trailing stops), negative balance protection, price alerts, and much more. Here, you can view all of eToro’s account features.

eToro Imminent Close

At some point, when copying a trader on the eToro platform, you will wish to stop replicating their trades.

When you duplicate an investor on the eToro platform, that investor will be listed in your eToro portfolio.

You can select the stop copying option after selecting a portfolio item. This changes the portfolio item’s status to eToro Pending Close.

When an action to halt copying is initiated within the eToro system, the platform will seek to close any associated positions. When you initiate a stop copying request, it is possible that not all relevant financial markets and exchanges are currently open. For instance, if your portfolio contains British stocks but the British stock markets are not yet open.

You can only sell your financial assets while the corresponding exchange is open. Your associated close orders will be executed when the relevant financial exchanges open. This is especially important to keep in mind over the weekend, when most markets are closed and reopen on Monday. Time differences between geographical locations and varying bank and public holidays may impact when your eToro available balance is updated and when your trading positions are actually closed.

CFD Trading on the eToro Platform

Let’s examine the fundamentals of eToro leverage usage.

eToro offers CFDs, which are leveraged products; in this case, ten times leverage is described.

You have a ten thousand dollar position, but you’ve only committed one thousand dollars, or one tenth of the account’s value. You are in a position where a tiny amount of money controls a much larger financial position. Herein lies your advantage.

Simply defined, leverage multiplies both gains and losses.

In trading, eToro leverage multiplies both gains and losses.

Suppose you use the eToro trading platform to purchase/sell $10,000 worth of General Electric (GE) using contracts for difference (CFDs).

Suppose General Electric (GE) gains 10% due to positive results, increasing the value of your stock from $10,000 to $11,000.

It has increased in value by 10%, or $1000, which is a 100% increase on the funds initially invested to the leverage CFD transaction.

Our initial investment of ten thousand dollars for the deal has yielded a profit of one thousand dollars because the price has increased by ten percent.

The eToro leverage is bidirectional. If General Electric (GE) falls 10% on week results, your ten-thousand-dollar stock is now only worth nine-thousand dollars. It’s decreased by one thousand dollars.

CFDs on eToro are primarily employed for short- to medium-term transactions. For example, intraday CFD trading on eToro. A CFD trade can be more flexible than a traditional market deal in which the underlying asset is owned, notwithstanding the significant risk associated with CFDs’ independence from financial markets. CFD trading provides access to CFD fractional shares, CFD global markets, and CFD short selling. CFDs can also be used for hedging by skilled traders.

Always keep in mind that CFDs are intricate products with a significant danger of losing money quickly owing to leverage. 78% of retail investor accounts that trade CFDs with this supplier lose money.

Limiting Your Risk When Using eToro’s Trading Platform Negative Balance Protection

We ought to discuss negative balance protection with eToro. When trading with leverage, a negative movement could cause you to lose more than your account balance at eToro. If your broker is regulated by the FCA, Negative Balance Protection should be implemented by default. Your eToro account could potentially become negative. We advise you to utilize negative balance protection. Using negative balance protection guarantees that your losses will never exceed the account’s current balance.

Limit Trading Risk using eToro’s Stop Loss and Stop Limit Orders

A stop-loss order is an order placed with a broker, such as eToro, to buy/sell a stock once it hits a specified price. The purpose of a stop-loss is to limit a trader’s loss on a security position.

Unless the trade is hedged against another trade or the trader is not utilizing leverage, most traders must utilize stop losses to protect themselves against enormous danger. The circumstances vary based on the trade and markets.

Education Resources at eToro

To trade successfully using eToro, it is essential to have a thorough understanding of the platform’s trading tools and marketplaces. Ensure that you fully utilize all educational resources. This comprises both internal and external education tools.

eToro provides a variety of instructional resources. Take your time and study the movement of the financial markets. Spend some time learning how your trading platform operates. Learn how to execute buy/sell transactions, take advantage of worldwide trading times, and, most importantly, mitigate and manage investment risk.

eToro Online Webinars

eToro offers weekly online 90-minute webinars and exclusive trading podcasts with industry leaders and seasoned traders to traders seeking to bridge knowledge gaps. Regardless of your current level, you have something to gain. Additionally, eToro offers online Market Watch webinars that go into the more technical aspects of trading.

eToro Financial Guides and Tutorial Articles

eToro has a financial guides area that you can use at any time if you want to learn more about specific financial issues.

eToro Podcasts

If you prefer to absorb knowledge through podcasts, eToro has a weekly 20-minute audio entitled Digest and Invest. These are accessible through the eToro dashboard and are hosted by professional traders Henry Ward and Dylan Holman.

eToro Customer Support

As part of our eToro review, we evaluate customer service options, response times, and the effectiveness of eToro trading platform problem resolution. eToro supports numerous languages, including English, German, Spanish, French, and Italian.

eToro has a support and customer service rating of triple AAA because they offer a variety of languages, live chat, email, and phone help.

eToro’s customer assistance is available in several languages from across the globe. Having a broker who can employ people from different parts of the world who can interact with you in your native tongue is a great advantage when attempting to resolve issues.

You must have a favorable customer service experience with eToro in order to trade the financial markets on the eToro platform effectively. eToro must ensure that all of your queries are handled and all platform difficulties are resolved. When a consumer of eToro has questions about eToro, the eToro customer service team should take these concerns seriously and provide a prompt and effective response. We gave eToro’s customer care a high rating due to their excellent customer service team.

eToro Livechat Support

We tested the eToro live chat and found it to be functional. We sent livechat messages via their app and website and received a response within three minutes. You must test the eToro chat service for yourself. A responsive chat service from eToro provides chat service consumers with excellent support. It is far superior to waiting days for an email.

We evaluated eToro’s customer service in multiple languages and nations. Our consumer complaints were swiftly resolved by the eToro help desk.

Email eToro Support

We wrote multiple emails to eToro, and their response times were generally outstanding. The quickest response time from eToro was within 2 minutes, while the longest response time was 3 hours. Support response times with eToro may vary for you, but this was our experience after sending 10 emails at various times.

Our questions were resolved and answered by the team. eToro provides superior email assistance overall.

Phone Assistance at eToro

Phone Support is not offered by eToro.

Although eToro does not offer phone assistance, its ticketing and live chat systems are highly successful. The eToro live chat was swift and may have been far more effective than a phone call.

What is required to open an eToro account?

As eToro is regulated by the Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), the Markets In Financial Instruments Directive (MiFID), and the Australian Securities and Investments Commission (ASIC), every new client must pass a few basic compliance checks to ensure they understand the risks of trading and are permitted to trade. When you open an account, you will likely be required to provide the following information:

• Be aware that the expiration period of Proof of Address documents for various eToro Brand entities may vary.

• A scanned color copy of your passport, driver’s license, or national identification card

• A utility bill or bank statement showing your address from the preceding three months

In addition, you’ll need to answer a few simple compliance questions to verify your trading experience, so you should set aside at least 5 minutes to finish the account opening procedure.

While you may be able to explore the eToro platform immediately, you won’t be allowed to trade until you pass compliance, which can take several days depending on your scenario.

To begin the process of opening an eToro account, please visit the eToro trading platform.

CFDs are leveraged instruments that can result in substantial losses in excess of the capital deposited. All trading entails risk. Only risk capital that you are willing to lose. Past performance does not guarantee future results.

This article is for educational purposes only and is not intended as investment advice. All information acquired on September 1, 2022 from https://www.etoro.com.

Is eToro A Reputable Broker?

We spent nearly three months analyzing eToro thoroughly. Despite the fact that eToro is not flawless, the overall product from eToro has several valuable features. Our personal experience with eToro trading was excellent. eToro is a good broker based on numerous considerations.

• eToro has a history of providing Stocks, Commodities, Forex, CFDs, Social Trading, Indices, Cryptocurrency, Index-Based Funds, and Exchange-Traded Funds (ETF).

• eToro has been in existence for nearly 15 years.

• eToro’s customer service staff consists of at least 10 people.

• The Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), the Markets In Financial Instruments Directive (MiFID), and the Australian Securities and Investments Commission regulate eToro (ASIC). This means that eToro is governed by a country that can hold a broker accountable for its mistakes, or at the very least, arbitrate larger disagreements.

• eToro is governed by respected regulators.

• eToro is able to handle deposits and withdrawals within two to three days. This is crucial during the withdrawal of cash.

• eToro has a global presence in numerous nations. This includes local lectures and training for eToro.

• eToro is able to hire individuals from all over the world who can speak in your native tongue.

eToro Disclosure of Risk

eToro is a multi-asset platform that allows investors to invest in stocks, cryptocurrencies, and CFDs.

Please be aware that CFDs are complicated instruments with a high risk of fast loss owing to leverage. 78% of retail investor accounts that trade CFDs with this supplier lose money. You should examine if you comprehend how CFDs operate and whether you can afford the substantial risk of losing money.

The past is not indicative of future performance. The disclosed trading history spans fewer than five full years and may not constitute as a basis for an investment choice.

Copy trading is a portfolio management service offered by eToro (Europe) Ltd., a company licensed and regulated by the Cyprus Securities and Exchange Commission.

In several EU countries, cryptoasset investments are very volatile and uncontrolled. There is no consumer protection. Profits may be taxable.

eToro USA LLC does not offer CFDs and makes no warranty and assumes no liability for the accuracy or completeness of the content of this publication, which was generated by our partner using publicly accessible, non-entity-specific information about eToro.

Trading Risk Disclaimer

Trading financial assets, such as cryptocurrencies and foreign currency markets, carries a significant degree of risk. Regarding leverage and margin-based trading, there is a substantial danger of loss. Some off-exchange financial instruments and derivatives may feature variable leverage, minimal regulatory protection, and substantial market volatility. Never assume that any investment products, strategies, indications, or other materials given will result in profits. You should be aware that investing may result in financial loss.

ETORO Frequently Asked Questions

Read our updated and extensive eToro FAQ section for the year 2022.

Can I sample eToro?

eToro provides a demo account so that users can test the eToro platform with simulated trading before making a deposit. eToro’s virtual trading environment is risk-free. LEARN MORE HERE

What kind of deposits does eToro accept?

Please note that the payment methods listed below vary per eToro Entity and Client Country of Residence.

Among other payment methods, eToro accepts credit cards, VISA, MasterCard, Maestro, debit cards, bank transfers, PayPal, Neteller, Skrill, WebMoney, Giropay, and electronic wallets (eWallets).

Is eToro safe?

Financial Behaviour Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), Markets In Financial Instruments Directive (MiFID), and Australian Securities and Investments Commission (ASIC) regulate and monitor the conduct of eToro (ASIC). Traders’ deposits to their eToro accounts are maintained in a separate bank account. For enhanced protection, eToro utilizes Tier-1 banks. Tier 1 is the official indicator of a bank’s financial stability.

Is eToro trading effective?

eToro is a reputable and trustworthy trading platform. Over 27,000,000 traders and eToro members utilize eToro. eToro provides trading in Stocks, Commodities, Forex, CFDs, Social trading, Indices, Cryptocurrency, Index Based Funds, and Exchange Traded Funds (ETF). eToro’s minimum deposit is 50.

Is eToro legitimate?

eToro was formed in 2007 in Cyprus, UK. Since 2002, eToro has facilitated trading on the financial markets. eToro provides Stocks trading, Commodities trading, Forex trading, CFDs trading, Social trading, Indices trading, Cryptocurrency trading, Index Based Funds trading, and Exchange Traded Funds (ETF) trading to clients. eToro holds all deposited funds in separate bank accounts for security purposes. eToro is legitimate because it is regulated by the Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), Markets In Financial Instruments Directive (MiFID), and Australian Securities and Investments Commission (ASIC).

Is eToro a good broker?

eToro is supervised by the top-tier financial regulators Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), Markets In Financial Instruments Directive (MiFID), and Australian Securities and Investments Commission (ASIC), and is therefore regarded as a reliable broker. eToro permits trading in Stocks, Commodities, Forex, CFDs, Social trading, Indices, Cryptocurrency, Index-Based Funds, and Exchange Traded Funds (ETFs).

Is eToro a reliable broker?

eToro can be regarded dependable. All funds deposited with eToro are placed in a separate bank account. This implies that eToro does not hold your funds directly. The broker does not have direct access to your cash and hence cannot misappropriate them. eToro is additionally governed by the Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), the Markets In Financial Instruments Directive (MiFID), and the Australian Securities and Investments Commission (ASIC).

What is eToro’s minimum deposit requirement?

eToro’s minimum deposit requirement is $50.

How long do withdrawals from eToro take?

Withdrawing funds from eToro typically takes between two and five days, depending on the withdrawal method.

Is eToro governed?

The Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), the Markets In Financial Instruments Directive (MiFID), and the Australian Securities and Investments Commission regulate eToro (ASIC). Regular assessments and audits are conducted by regulatory agencies as part of eToro’s regulatory compliance. You may discover more about these reviews on the websites of the relevant regulators.

Is eToro a market maker?

eToro is a market maker. eToro will purchase stocks, money, and other commodities and instruments even if no buyer has been identified.

How can I begin trading on eToro?

In order to start a trading account with eToro, you must register here. After receiving your login information through email, submitting your identification documents for account validation, and making a deposit, the next step is to download your preferred trading platform. Here you may discover full information on eToro trading platforms.

Are my funds secure with eToro?

The Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), the Markets In Financial Instruments Directive (MiFID), and the Australian Securities and Investments Commission regulate eToro (ASIC). The governing body and regulatory status of a broker, such as eToro, is one of the most significant factors for traders to consider when choosing a broker. Brokers who operate without regulation do so at their own discretion and endanger the safety of their clients’ funds.

Due to the regulations imposed, it is improbable that regulated brokers will manipulate market prices. eToro will honor your withdrawal request when you submit it. If they violate any regulatory requirements, their status as a regulated entity may be revoked.

Is eToro a con?

eToro is well-established and regulated, having been in business for over 15 years. eToro is legitimate.

Can one earn money using eToro?

Despite the fact that eToro has been a fantastic success for traders. Using eToro to trade on the financial markets is not a get-rich-quick scam. If you educate yourself, use a demo account for practice, and carefully plan your trades, your likelihood of success will increase significantly. Never invest funds that you cannot afford to lose. 78% of retail investor accounts that trade CFDs with this supplier lose money.

Does eToro cost money?

eToro charges a withdrawal fee of $5. Foreign currency withdrawals incur currency translation fees. eToro does charge inactive accounts a fee. eToro doesn’t impose deposit fees.

When was eToro established?

eToro was established in 2007

How many individuals use eToro?

There are more than 27,000,000 registered eToro users.

What nation is eToro headquartered in?

eToro’s headquarters are located in Cyprus, United Kingdom.

Does eToro give protection against negative balances?

eToro gives insurance against negative balances. Traders cannot lose more than they have deposited when negative balance protection is in place.

Does eToro offer stop loss guarantees?

eToro does not offer stop loss guarantees. Risk is handled with assured stop loss protection. Traders are obligated to close your trade at the price you specify. Only during market hours and under normal market conditions are Stop Loss orders guaranteed.

Do you allow scalping on eToro?

Scalping is not offered by eToro.

Does eToro facilitate hedging?

Hedging is not offered by eToro.

Offers eToro CFD trading?

eToro facilitates CFD trading.

Provides eToro with STP?

eToro facilitates STP trading.

How many individuals use eToro?

eToro has over 27,000,000,000,000 users and traders.

eToro is an ECN broker, yes.

ECN trading is not offered by eToro.

Offers eToro a sample account?

eToro provides demo accounts.

Does eToro provide a Muslim account?

eToro provides a Muslim account.

What are the eToro funding options?

Please note that the various funding methods and possibilities for eToro clients may be found in the eToro Members area and depend on their country of residence. Please check the eToro website for your specific accessible payment methods. Credit cards, VISA, MasterCard, Maestro, Debit Cards, Bank Transfer, PayPal, Neteller, Skrill, WebMoney, Giropay, and electronic wallets are accepted by eToro (eWallets).

Among other methods of payment

Is eToro safe?

Financial Behaviour Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), Markets In Financial Instruments Directive (MiFID), and Australian Securities and Investments Commission (ASIC) regulate and monitor the conduct of eToro (ASIC). Traders’ deposits to their eToro accounts are maintained in a separate bank account. For enhanced protection, eToro utilizes Tier-1 banks. Tier 1 is the official indicator of a bank’s financial stability.

Is eToro trading effective?

eToro is a reputable and trustworthy trading platform. Over 27,000,000 traders and eToro members utilize eToro. eToro offers Stocks trading, Commodities trading, Forex trading, CFDs trading, Social trading, Indices trading, Cryptocurrency trading, Index Based Funds trading, and Exchange Traded Funds (ETF) trading. eToro’s minimum deposit is 50.

Is eToro legitimate?

eToro was formed in 2007 in Cyprus, UK. Since 2002, eToro has facilitated trading on the financial markets. eToro provides Stocks trading, Commodities trading, Forex trading, CFDs trading, Social trading, Indices trading, Cryptocurrency trading, Index Based Funds trading, and Exchange Traded Funds (ETF) trading to clients. eToro holds all deposited funds in separate bank accounts for security purposes. eToro is legitimate because it is regulated by the Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), Markets In Financial Instruments Directive (MiFID), and Australian Securities and Investments Commission (ASIC).

Is eToro a reputable broker?

eToro is supervised by the top-tier financial regulators Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), Markets In Financial Instruments Directive (MiFID), and Australian Securities and Investments Commission (ASIC), and is therefore regarded as a reliable broker. eToro permits trading in Stocks, Commodities, Forex, CFDs, Social trading, Indices, Cryptocurrency, Index-Based Funds, and Exchange Traded Funds (ETFs).

Is eToro a reliable broker?

eToro can be regarded dependable. All funds deposited with eToro are placed in a separate bank account. This implies that eToro does not hold your funds directly. The broker does not have direct access to your cash and hence cannot misappropriate them. eToro is additionally governed by the Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), the Markets In Financial Instruments Directive (MiFID), and the Australian Securities and Investments Commission (ASIC).

What is eToro’s minimum deposit requirement?

eToro’s minimum deposit requirement is $50.

How long do withdrawals from eToro take?

Withdrawing funds from eToro typically takes between two and five days, depending on the withdrawal method.

Is eToro governed?

The Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), the Markets In Financial Instruments Directive (MiFID), and the Australian Securities and Investments Commission regulate eToro (ASIC). Regular assessments and audits are conducted by regulatory agencies as part of eToro’s regulatory compliance. You may discover more about these reviews on the websites of the relevant regulators.

Is eToro a market maker?

eToro operates as a market maker. eToro will purchase stocks, money, and other commodities and instruments even if no buyer has been identified.

How can I begin trading on eToro?

In order to start a trading account with eToro, you must register here. After receiving your login information through email, submitting your identification documents for account validation, and making a deposit, the next step is to download your preferred trading platform. Here you may discover full information on eToro trading platforms.

Are my funds secure with eToro?

The Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), the Markets In Financial Instruments Directive (MiFID), and the Australian Securities and Investments Commission regulate eToro (ASIC). The governing body and regulatory status of a broker, such as eToro, is one of the most significant factors for traders to consider when choosing a broker. Brokers who operate without regulation do so at their own discretion and endanger the safety of their clients’ funds.

Due to the regulations enforced, it is improbable that regulated brokers will manipulate market pricing. eToro will honor your withdrawal request when you submit it. If they violate any regulatory requirements, their status as a regulated entity may be revoked.

Is eToro a con?

eToro is well-established and regulated, having been in business for over 15 years. eToro is legitimate.

Can one earn money using eToro?

Despite the fact that eToro has been a fantastic success for traders. Using eToro to trade on the financial markets is not a get-rich-quick scam. If you educate yourself, use a demo account for practice, and carefully plan your trades, your likelihood of success will increase significantly. Never invest funds that you cannot afford to lose. 78% of retail investor accounts that trade CFDs with this supplier lose money.

Does eToro cost money?

eToro charges a withdrawal fee of $5. Foreign currency withdrawals incur currency translation fees. eToro does charge inactive accounts a fee. eToro doesn’t impose deposit fees.

When was eToro established?

eToro was established in 2007

How many individuals use eToro?

There are more than 27,000,000 registered eToro users.

What nation is eToro headquartered in?

eToro’s headquarters are located in Cyprus, United Kingdom.

Does eToro give protection against negative balances?

eToro gives insurance against negative balances. Traders cannot lose more than they have deposited when negative balance protection is in place.

Does eToro offer stop loss guarantees?

eToro does not offer stop loss guarantees. Risk is handled with assured stop loss protection. Traders are obligated to close your trade at the price you specify. Only during market hours and under normal market conditions are Stop Loss orders guaranteed.

Do you allow scalping on eToro?

Scalping is not offered by eToro.

Does eToro allow hedging?

Hedging is not offered by eToro.

Offers eToro CFD trading?

eToro facilitates CFD trading.

Provides eToro with STP?

eToro facilitates STP trading.

How many individuals use eToro?

eToro has over 27,000,000,000,000 users and traders.

eToro is an ECN broker, yes.

ECN trading is not offered by eToro.

Offers eToro a sample account?

eToro provides demo accounts.

Does eToro provide a Muslim account?

eToro provides a Muslim account.

What are the eToro funding options?

Please note that the various funding methods and possibilities for eToro clients may be found in the eToro Members area and depend on their country of residence. Please check the eToro website for your specific accessible payment methods. Credit cards, VISA, MasterCard, Maestro, Debit Cards, Bank Transfer, PayPal, Neteller, Skrill, WebMoney, Giropay, and electronic wallets are accepted by eToro (eWallets).

4 Comments